CHECK PRINTING & INTERNAL RECONCILIATION IN SAP B1

Printing checks is an important payment process for most U.S. businesses. The setup for printing checks usually requires some help from an implementation partner. Part of the check printing process involves making sure that the correct printer is designated for check printing and the check forms are loaded and ready to go.

Once setup is done, printing the checks is easy. Simply choose your house bank, verify the next check number and print. Once the printing is done you need to confirm the assigned check numbers with an option to make additional corrections

You can choose one of three preferences to print checks:

● Blank Paper. This option is primarily for companies that do not use a pre-printed check stock, where checks are printed in electronic format (also called MICR)

● Overflow Check Stock. If the check stub overflows to the next page, the system continues to use the pre-numbered check stock for all pages, while voiding the numbers that were used for overflow.

● Overflow Blank Paper. The system prints the first page of the check on the regular pre-numbered check stock. For overflow pages, the system pauses, asks you to replace the check stock, with non pre-numbered pages, and prints the rest on blank checks.

To define the printing preferences go to Administration → System Initialization → Print Preferences → Per Document → Checks for Payments.

You can override the company default printing method when you define your house banks. `Go to Administration → Setup → Banking → House Bank Accounts → Paper Type field

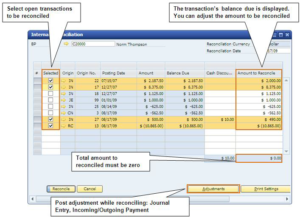

INTERNAL RECONCILIATION

Internal reconciliation is a mechanism that runs in the background of SAP Business One and automatically performed for documents; however users can also conduct internal reconciliation manually. You may wonder how critical internal reconciliation is to run in your company. Well, the answer is that internal reconciliation is absolutely critical! Essentially, internal reconciliation matches debits and credits in the same G/L account or business partner. For example, an invoice is matched with a payment or a credit, or a payment is matched with a deposit. If no, internal reconciliation was performed by SAP Business One, invoices would remain open even if they paid. Imagine that your invoice remain open after they paid. You would not be able to do collections from customers, pay vendors and more.

In SAP Business One, when you apply a document to another document, and a posting is made to the general ledger, an internal reconciliation normally takes place, and you do not have to do anything more. In a few cases you will have to complete the process by conducting manual reconciliation.

Manual reconciliation is necessary in the following cases:

● For a payment on account, where the invoice was created after the payment

● When writing off any rounding or over/under payments differences

● To match transactions for a business partner that is both a customer and a vendor

● To make corrections to previously reconciled transactions

To internally reconcile a G/L account, go to Financials →Internal Reconciliations → Reconciliation and choose the account.

To access internal reconciliation for a business partner go to Business Partners →Internal

Reconciliation → Reconciliation. Select the Business Partner and click Reconcile. If you have customers that are also vendors, check the Multi BP’s box and choose both master records. You can also access internal reconciliation for a business partner if you open the business partner account balance, and choose the Internal Reconciliation button.

Internal reconciliation supports cash discount calculation, exchange rate differences, and over/under payment scenarios when you reconcile a single payment with one or more invoices

Get started today.

Visit: www.emerging-alliance.com