SAP B1 Troubleshooting – GST tax code is selected; You must select SAC code in line 1

Simplifying GST Compliance: Resolving the SAC Code Error in SAP B1

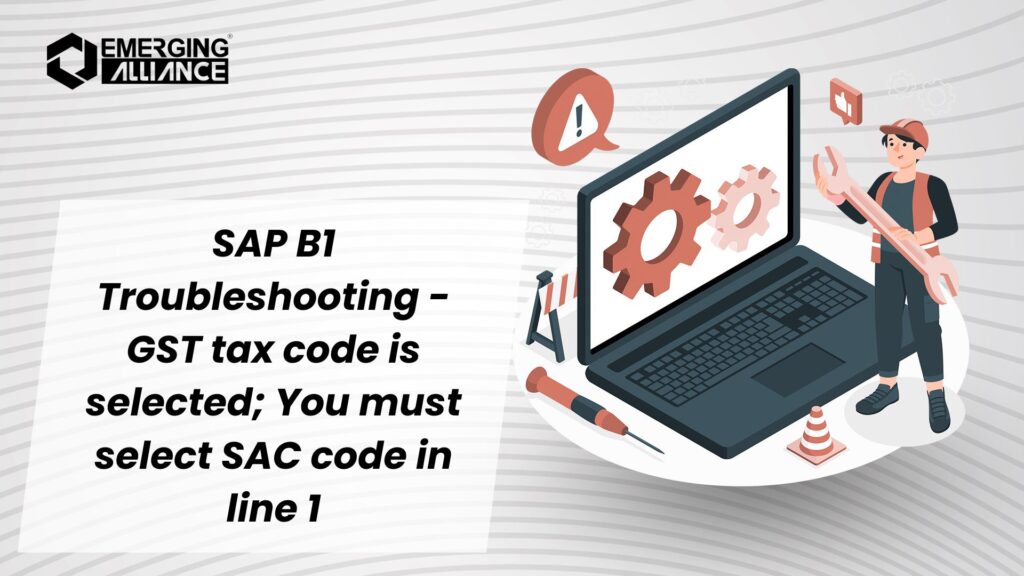

SAP Business One users frequently encounter errors related to compliance with GST norms in India. One such issue is the “A GST tax code is selected; you must select an SAC code in line 1” error, which appears while processing service-related marketing documents. Let’s dive into the root cause and the solution for resolving this issue effectively.

Error Description

When creating service-related marketing documents such as service invoices, the system throws the following error message:

Error Message: A GST tax code is selected; you must select an SAC code in line 1.

Root Cause

The error occurs because the SAC (Service Accounting Code) has not been provided at the row level of the document. According to GST compliance norms, every service invoice requires a valid SAC code to ensure accurate tax calculations. Without this, SAP Business One prevents you from posting the document.

Solution

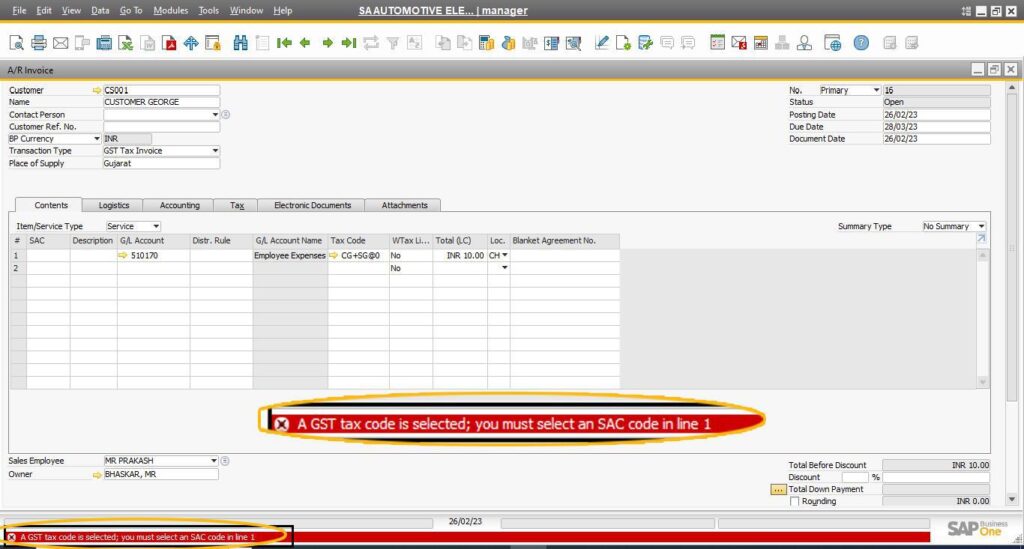

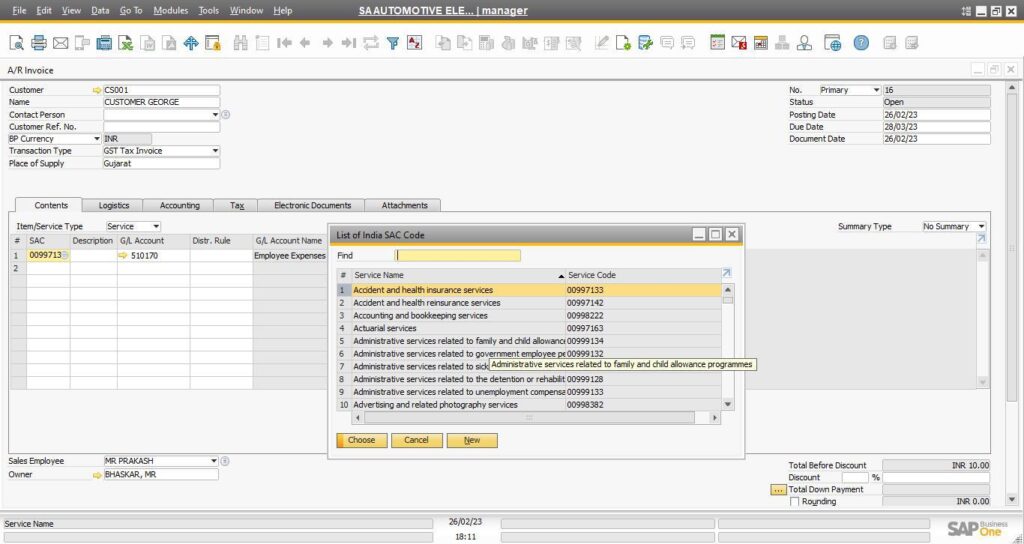

To resolve this issue, you need to manually enter the appropriate SAC code at the row level of the document. Here’s how you can do it:

- Open the service-related marketing document in SAP Business One.

- Navigate to the row level of the document where the error is occurring.

- Enter a valid SAC code in the designated field.

- Revalidate the document and attempt to post it.

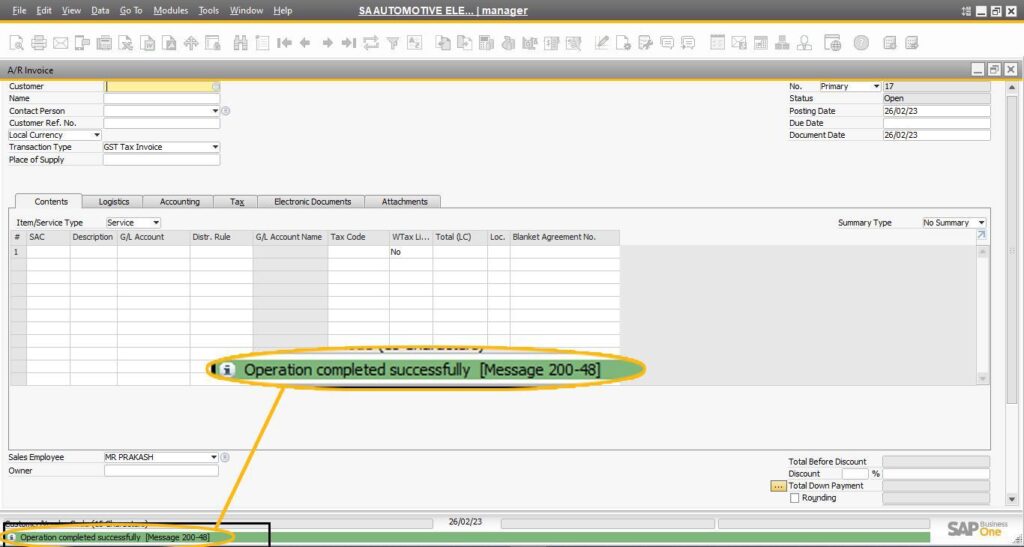

Once the SAC code is entered correctly, the system will allow you to successfully add the document without further errors.

Key Takeaways

- SAC codes are mandatory for all service-related invoices under GST norms.

- Errors like “A GST tax code is selected; you must select an SAC code in line 1” occur due to missing SAC codes at the row level of documents.

- By ensuring proper SAC code entry, you can prevent compliance-related posting issues.

Importance of SAC Codes for GST Compliance – FAQ

1. What is the “A GST tax code is selected; you must select an SAC code in line 1” error?

- This error occurs in SAP Business One when you’re trying to create a service-related invoice or marketing document but haven’t provided an SAC (Service Accounting Code) at the row level of the document. The SAC code is required for GST compliance.

2. Why do I need to enter an SAC code in SAP Business One?

- Under GST regulations in India, every service-related invoice must have an SAC code to properly classify the service and apply the correct tax rate.

3. What is an SAC code?

- An SAC (Service Accounting Code) is a unique code used to classify services under GST. It helps in determining the appropriate tax treatment for the service.

4. How do I resolve the “SAC code missing” error in SAP Business One?

- To fix the error, you need to manually enter a valid SAC code at the row level of the document where the service is listed. Once the code is entered, the error should be resolved.

5. Where do I find the SAC code field in the SAP Business One document?

- The SAC code field is usually located at the line item level of the service-related marketing document. You’ll see it next to the service item or description in the document.

6. What should I do if I don’t know which SAC code to use?

- You can refer to the GST service classification list provided by the Indian government or consult with your tax advisor to choose the appropriate SAC code for the service you’re providing.

7. Can I select an SAC code at the document level instead of the row level?

- No, SAC codes must be selected at the row level for each individual service item. This ensures accurate classification for each type of service.

8. What happens if I forget to enter an SAC code?

- If you fail to enter the SAC code, SAP Business One will throw an error and prevent you from posting the document, as the system cannot process the tax without the correct SAC code.

9. Are SAC codes required for all types of invoices?

- SAC codes are only required for service-related invoices. They are not necessary for product-based invoices (goods-related invoices) under GST.

10. How can I avoid this error in the future?

- Always ensure that you select a valid SAC code when creating a service-related invoice. If your services are regularly invoiced, consider setting up default SAC codes for faster processing.

For more SAP Business One tips and solutions, stay tuned to my blog series. Let’s simplify SAP B1 for smoother operations and better compliance!

![SAP B1 Troubleshooting – Posting period locked; specify an alternative date [Msg 131 107]](https://www.emerging-alliance.com/wp-content/uploads/2025/01/SAP-B1-Troubleshooting-Solving-Stock-Challenges-Guide-to-Inventory-Errors-7_11zon-600x474.png)

![SAP B1 Troubleshooting - Only a production or template BOM can be defined as a purchase item, 'ITEM A00006' [Msg 3566-4]](https://www.emerging-alliance.com/wp-content/uploads/2025/01/SAP-B1-Troubleshooting-Solving-Stock-Challenges-Guide-to-Inventory-Errors-6_11zon-600x474.png)

![SAP B1 Troubleshooting – Inactive sales employee; specify active sales employee [Sales Order Sales Employee] [Msg 173207]](https://www.emerging-alliance.com/wp-content/uploads/2025/01/SAP-B1-Troubleshooting-Solving-Stock-Challenges-Guide-to-Inventory-Errors-5_11zon-600x474.png)

![SAP B1 Troubleshooting - Generate this document, first define numbering series in Administration module. [message 131-3]](https://www.emerging-alliance.com/wp-content/uploads/2025/01/SAP-B1-Troubleshooting-Generate-this-document-first-define-numbering-series-in-Administration-module.-message-131-3-600x474.jpg)