SAP B1 Troubleshooting – GST Tax Codes Can Be Selected for GST Items

GST Tax Codes Can Be Selected for GST Items Only – How to Resolve It

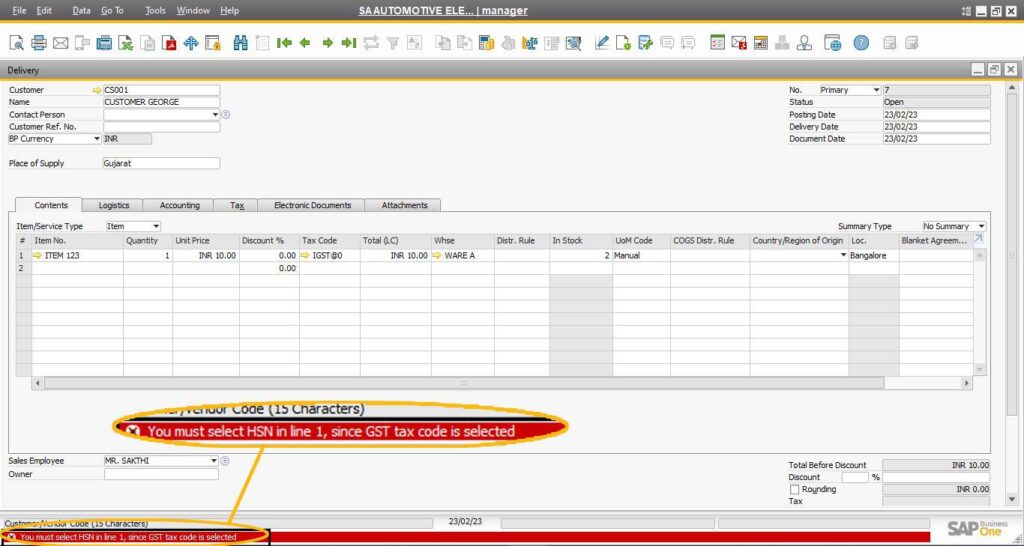

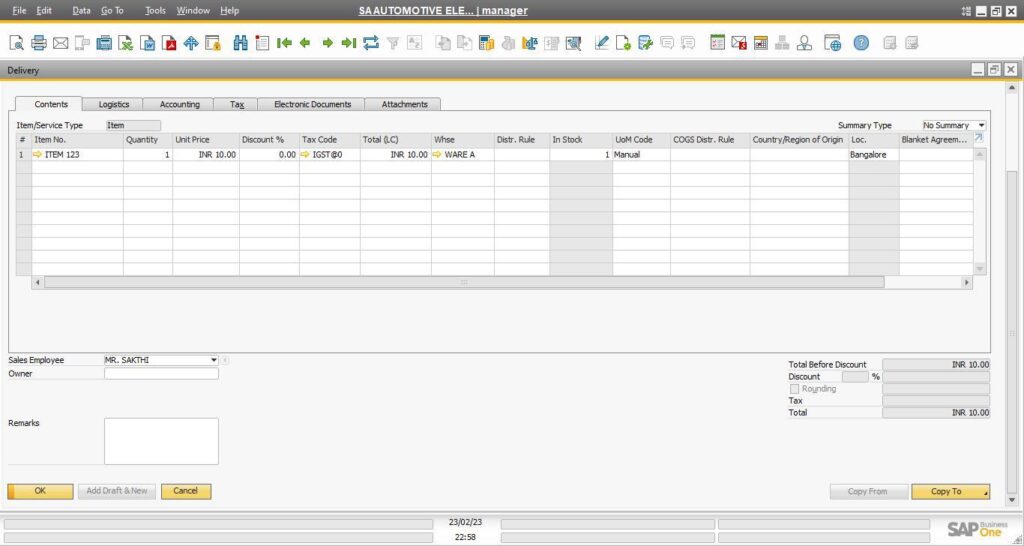

Marketing transactions in SAP Business One sometimes trigger the error: GST tax codes can be selected for GST items or services only, see row 1. This guide provides a step-by-step approach to diagnosing and resolving this issue.

Error Description

When attempting a marketing transaction, you might encounter the following error message:

“GST tax codes can be selected for GST items or services only, see row 1.”

Root Cause

The error arises due to missing GST information in the Item Master Data for the specific item listed in the error message. SAP Business One requires proper GST-related details for the items to process transactions seamlessly.

Solution Steps

Follow these steps to resolve the issue:

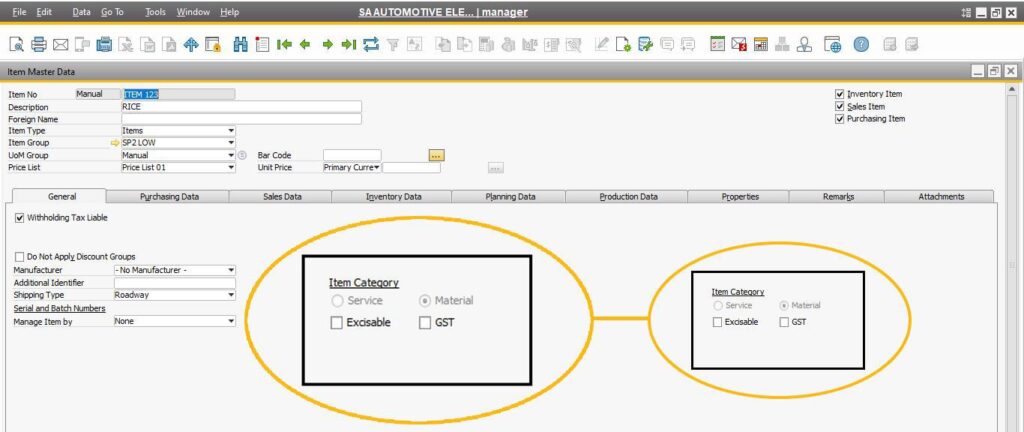

1. Verify Item Master Data

- Navigate to the Item Master Data of the item mentioned in the error message (e.g., line number from the error details).

- Check if GST-related fields are correctly configured.

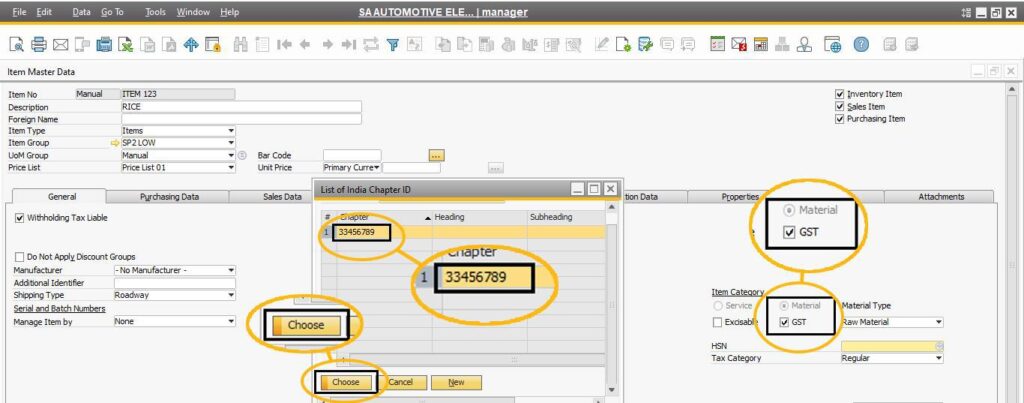

2. Enable GST and Provide HSN Code

- Ensure that the GST checkbox is enabled.

- Input the HSN code for the item.

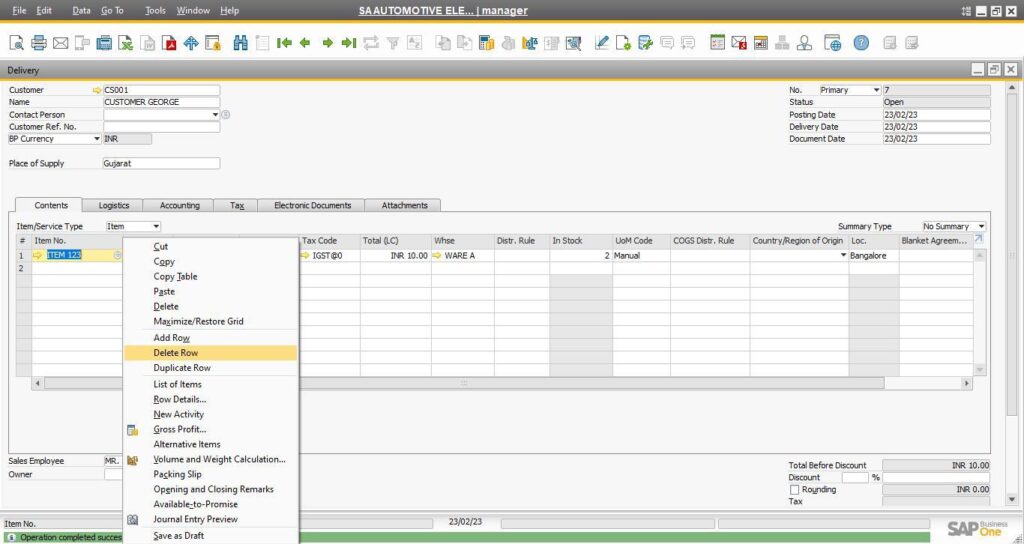

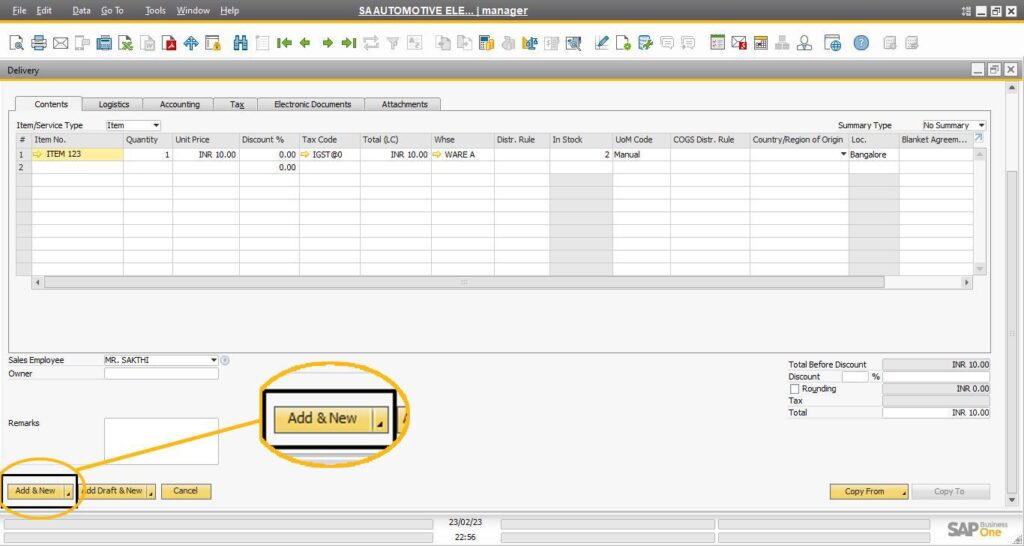

3. Correct the Document

- Delete the affected line in the document where the error occurred.

- Re-add the item after making the necessary updates in the Item Master Data.

4. Special Note for Base Documents

- If the transaction is based on a base document (e.g., Sales Order or Purchase Order), update the base document first.

- Avoid making changes directly in the target document to prevent inconsistencies.

By updating the Item Master Data with accurate GST details and re-adding the item to the document, this error can be resolved effectively. Ensuring GST configuration is completed during item setup will help avoid similar issues in the future.

Keep your GST settings updated to maintain smooth and error-free marketing transactions in SAP B1, By following these guidelines, you can quickly restore access to SAP Business One and minimize downtime.

Looking for professional guidance? Complete the form below and let’s connect soon!